» The Origin and Purpose of Medicare Supplemental Insurance

The term “Medigap” had its origin in Original Medicare. The gaps within Medicare left a massive space (void) to be filled-in. The success of Medicare supplemental insurance has put the doubts to rest that people cannot afford quality health care system. It has become easily accessible to one and all. You can buy one of the best plans and start enjoying the benefits. It is a great way to build a stronger nation.

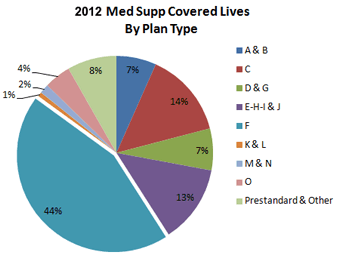

The senior citizens find it to be just more than any other insurance product sold. Medicare supplemental insurance has been classified into ten different plans. The results are in front of us! Each plan has become widely popular in the market. It works together with Medicare to make a formidable partnership.

The Price Factor proves to be a Boon:

The low rates have led the revolution on. An everyday citizen who is looking to secure a healthy future has the option to contact a private insurance company to buy an affordable plan. These plans are sold by the private companies.

The uniformity level across all the companies makes it convenient for people to focus on key aspects. The Federal government has regularized all the plans.

Insurance rates are dependent on several factors. The higher premium amount guarantees a wider network of services. It is great if someone can afford the best plan. You have Plan F and Plan G available.

It is not the end of story! The rest of plans have different audience sections to aim at. It must not be forgotten that supplemental insurance came into existence to offer more coverage and benefits to people. The price factor is only a means to make you aware of the underlying difference found among all the plans.

The best Medicare Supplemental Insurance Plan and You:

You should get insurance quotes from different companies. It is a humble request to try to buy a plan during the Open Enrollment Period. The pre-existing conditions would make no difference at all. These companies cannot reject or deny you from submitting the application. There is no requirement for medical screening or health underwriting etc.

You must show the desire to find the best policy. The health conditions differ from person to person. Medicare supplemental coverage plans have been designed to provide coverage to every single member of the society.

The single most influential aspect is that it is working closely with Medicare to provide better quality services to the beneficiaries.

rd/474/80/04192012