» Essential Facts About Medicare Supplement Plans

Introduction to Medicare Supplement Plans:.

Medicare Supplement Plans are marketed and sold by private Medicare supplement companies, and are different from Medicare advantage plans (like PPO or HMO). This insurance policy is also known by the name “Medigap Insurance”.

A person receiving original Medicare can really benefit from enrolling in a Medicare supplement policy to cover out-of-pocket expenses such as coinsurance, copayments and yearly deductibles in Medicare.

The insurance market has a number of Medicare supplement plans to choose from. Every Medicare insurance company has its own plans and this leads to big differences in the costs. Although administered by private companies, all Medigap policies must adhere to guidelines set by Federal and state government to protect the interests of the insured.

Medicare supplement companies have to clearly state that only one person can be covered in a single Medicare supplement plan, and in case of married couple, both husband and wife need to purchase separate policies.

In the market there are many look a-like policies such as Medicaid, veteran’s benefits, employer’s or union’s plan, or long term care insurance policies, but they are different to Medicare supplement plans. It is essential that you choose genuine supplemental insurance to compliment your original Medicare policies.

Products and Services Covered under Medicare Supplement Plans:

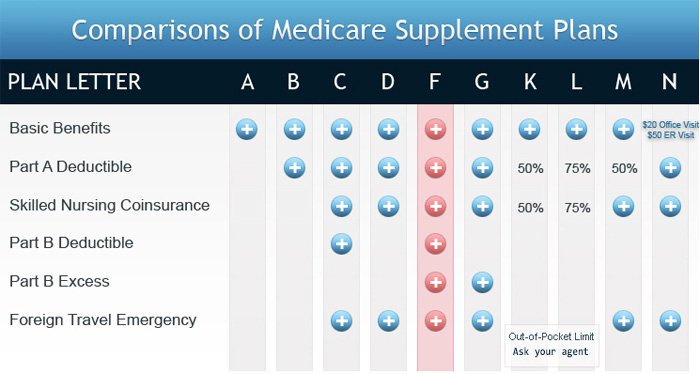

“Standardized” Medigap policies are also sold by Medicare supplement companies; all the policies are given the letters A, B, C, D, F, G, K, L, M, and N to distinguish one from the other. All the standardized insurance companies are required to provide the same basic benefits irrespective of the insurance company from which it is bought.

As per regulations, every Medicare supplement company must provide Medicare supplement Plan A in case they are offering any other policy under Medigap. There is no compulsion that the entire Medigap Insurance plan will be available in your state; not every plan has to have all the basic benefits.

Benefits that are included in Medicare supplement plans are:

- Medicare Part A and part B copayment or coinsurance

- Deductibles for Medicare Part A and Part B

- Emergency foreign travel

- Excess charges in Medicare Part B

- Coinsurance for skilled nursing care

- Preventive care left out by Medicare (up to $120)

- Hospital expenditure for 365 additional days after Medicare benefits are exhausted

When to enroll in a Medicare Supplement Plan

Medicare supplement plans should be purchased during the open enrollment period. People at or above 65 years of age and enrolled under Medicare Part B, have a guaranteed right to purchase Medicare supplement plan during the first six months after enrolling in Medicare. It is not possible to replace or delay this enrollment period.

The Medicare open enrollment period starts from the first day of the month when you turn 65 and enroll in Medicare Part B. The person has six months leading up this periodit to enroll in a Medicare supplement plan, in this period the Medicare supplement company cannot deny you enrollment in a Medigap policy or charge more on the basis of health problems.

The Medicare supplement company should eliminate or shorten the waiting period in case the health coverage passes the Medicare ‘Creditable coverage’ parameter covering all types of coverage under health care insurance.

Under creditable coverage there is no break for more than sixty three days in a row immediately prior to buying the policy. Consult your Medicare supplement company to know whether your basic health coverage is creditable coverage.