» An Overview of Medicare Supplement Insurance Benefits

As a kid, we all wonder what would happen to us when we will grow older and so did I. I remember, being a kid I always believed that the Medicare policies are only for those who are disabled, but then my granny educated me that it is for those who reach the age of 65.

I have learnt a lot from my grandmother, the things that might be helpful when I reach retirement and the most important thing that I have learnt is that getting Medicare Supplement benefits is consummate and necessary.

On reaching the age of 65, Americans are automatically enrolled in Original Medicare policy that provides the basic insurance coverage inclusive of Part A and Part B. The traditional policies are designed to help with the hospitalizations, the out-patient care, emergency services and medical equipments. Part A of this policy does not have any premium entailed to it, but the Part B has an entailed premium, which is paid to the private insurance companies.

The original Medicare policy covers 80 percent of the expenses and the rest 20 percent is to be shelled out from one’s own pocket. Paying for these 20 percent expenses can be an expensive affair especially for those who have limited income after their retirement. This is where Supplement benefits kicks in and pay for these 20 percent of expenses.

Medicare Supplement Plans:

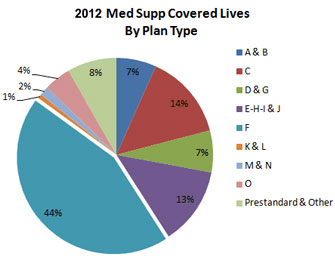

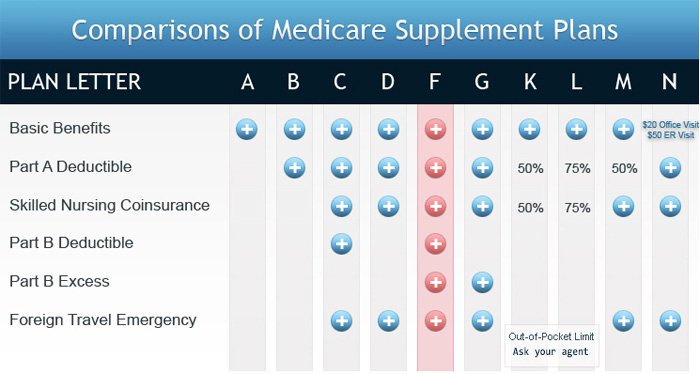

Medicare Supplement plans, often referred to as Medigap policies are standardized by CMS (Centers for Medicare and Medicaid Services), but are sold by private companies. These plans have been categorized into ten different plans, labeled from Plan A to Plan N. Each plan has different benefits and different premiums to be paid.

These plans are purchased by senior citizens to cut down the future cost of their medical expenses. These expenses can be those of the prescribed drugs, therapies, dental and vision care etc.

There are several reasons that one might consider while plunging into the Medicare supplemental insurance plan. These reasons can be described as below:

- It is boon for those who live on average or low income after they retire, as these supplemental insurance plans by Medicare help them to strike a balance in their budget and their medical expenses. Having the policy that helps one to safeguard himself from paying out of his pocket, at a small amount of premium is definitely a good deal to crack.

- There are two kinds of people who might be interested in buying Medicare supplement benefits: One those who are intricately rich and have no tension of the expenses incurring on their medical treatment and second those who do not have any or small amount of savings, as the amount of saving would not be able to suffice the expenses for a long period off time.

- One may not be getting all the services that they need from enrolling just in the Medicare policy, as it covers only the cost for hospital and out-patient’s cost. In such a scenario having a Medicare Supplemental benefits offers a wider options for people to choose from.

- They offer services like emergencies treatment in foreign, costs occurred to have skilled nurses, getting blood from blood banks, the cost for preventative care and the cost of prescription drugs. It depends upon the needs and the budget of an individual. It also prevents them from paying extra for the services that they do not need.

- The insurance coverage provided by supplement plan is guaranteed in nature as they cannot be cancelled once they have been enrolled in. The amount of premium is subjected to change, but the policy is renewed till the premiums are paid on time and there no misinformation that have been provided. So one does not need to worry about the renewal of policies as they are secured till they pay.

- Another feature of the Medicare supplemental plans is that it allows one to keep the same doctors and the same hospital that they are accustomed to. One does not have bother about leaving the network of their provider; all they might need is a referral in case they wish to see a specialist.

- If a person needs to travel intensively, these plans are portable in nature. One can easily travel anywhere and U.S and Abroad and avail the benefits of these policies as they are accepted worldwide.

- All the hospitals that accept Medicare policies, would accept Supplemental plans and provide insurance coverage if you need one.

- One can have a great deal of discount if their partner is expected to join in soon for the plan, leading to significant savings. Additionally many of Medicare supplemental Insurance providers offer free gym memberships, offsetting the premiums.

- Having Supplemental plans not only helps you in staying healthy, but also they help in living a better life as one can spend more towards luxury by saving on their medical expenses.

Medicare supplemental plans vary on the basis of gender, which means the cost of the premium is based on the unisex concept or different amounts for males and females. The cost of premium also varies from state to state, which means that the some states have high premiums and some have low premiums.

There are some plans that can afford guaranteed issue, depending on the certain specified circumstances. This means that one can apply for Medicare supplement plans and no medical questions would be imposed on the beneficiary.

Those suffering from pre-existing conditions can also enroll in it and save on their pockets by combining them with their original Medicare plans.

Medicare supplement benefits have an edge over advantage plans because of their flexibility and low premiums (as compared to advantage plans). They are benevolence if the choice of plans is done after a deep research and analysis of one’s requirements and keeping the pocket in mind before plunging into a Medicare supplemental plan.

mv/1050/200/04162012