» The Origin and Popularity of Medicare Supplement Plans:

Medicare supplement plan represents the progress made and strategies successfully implemented in the health care system in the last couple of years. It can also be taken as a reference point to how odd situations or difficulties can be turned into opportunities.

The popularity of Medicare supplemental plans is down to the fact that it offers more benefits at an affordable price. The failure of Medicare to live up to the expectations caused somewhat panic among senior citizens. It served as a platform for the private insurance companies to start exploring the hidden opportunities.

The age limit is 65 years for all the participants. The applicant must be enrolled in Medicare Part A and Part B to start enjoying all the benefits. The Open Enrollment Period lasts for six months starting the day you turn 65. It is the best time to enroll in a Medicare Supplement Plan.

People suffering from permanent disability or Chronic Kidney Disease (CKD) are entitled to receive Medicare benefits. This is not the case with Medicare Supplement Plans. The applicant should wait till he or she turns 65.

Medicare Supplemental Plans offer more benefits:

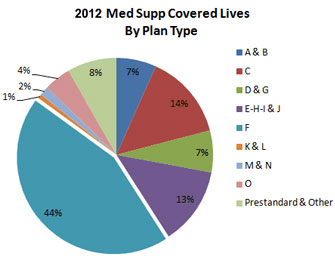

Medicare Supplement Plans are classified into ten parts. The premium amount depends on the kind of coverage offered by each plan. The success of Medicare supplement plans proves the point effortlessly that people are willing to spend given the condition that they get complete value on the purchased product.

Each Medicare supplemental plan is designed to serve specific health conditions. The senior citizens suffer from different types of health conditions. Each case is unique in itself. The idea behind creating ten different plans is to offer more options to the policyholders.

It is often witnessed that how one insurance plan cannot fit all the sizes. You should buy a Medicare supplemental insurance plan keeping all the good points in mind. It also means that you need to read all of them separately to find the best one.

Medicare supplemental plans offer wider coverage to its beneficiaries. The low-premium rate is something which has always been an added advantage. People have monthly budget to plan things accordingly. They cannot afford to make huge investments.

You should buy a Medicare supplemental plan which has low premium amount. It does not mean that you cannot have the best plans available. It is nothing more than just a myth. Medicare supplemental plans offer better benefits at a low-premium.

rd/416/60/04172012