Insurance: A Perfect Way to Start Living Healthy

The insurance sector has become a gold mine lately. The Federal-government led Medicare was designed to take care of health care related services of senior citizens. It brought a uniformity level into existence. There were widespread inequalities found earlier. The Title XVIII of Social Security Act passed Medicare in 1965. It became a landmark moment.

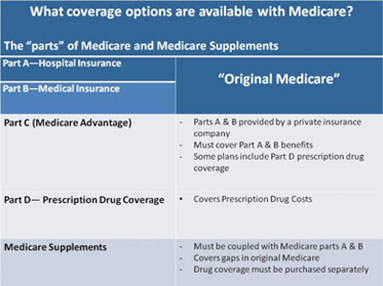

There are four parts of Medicare:

- Part A

- Part B

- Part C

- Part D

People, especially the senior citizens, were ecstatic to find a standardized health care system applied across all the states.

They knew that it was the beginning of a never-ending process. It proved to be the same. The concept is still evolving to this day. There were few broken links found.

The situation started to change as private insurance companies went on from taking the charge to dominate the market lately. Medicare Supplement and Advantage plans became hugely popular. People can buy an insurance plan of their choice and pay a low premium for it. The change came out to be positive in the end.

Medicare and its Early History:

The early history paved the way for future changes. The success of both, supplement and advantage plans, is solely based on the historical evolution. There are certain guidelines or rules to be followed by the applicants. The age limit is fixed at 65 years or over.

There are younger people who can also apply for Medicare given the condition they either receive Social Security Disability Insurance benefits. People suffering from Chronic Kidney Disease (CKD) are also eligible to apply. These changes were made over a period of time. The best part is that the whole approach has been centered on public welfare. These plans have been designed or developed around the basic concept.

The role of Medicare Advantage and Supplement plans in the Modern Era:

People have all the options available they can possibly think of. The budget factor is no longer treated as a hindrance now. You have several insurance plans available at low monthly premium.

Medicare advantage has been further classified into five different plans.

Medicare supplement has ten different plans. The insurance companies have taken a target-oriented approach here.

A senior citizen has all the good things to say when he starts learning about Medicare and then comes down to advantage and supplement plans in order. He or she feels satisfied at the number of options being offered.

The number of insurance plans sold has become a motivational factor for everyone involved with the business. The hard work done is paying off now. It is a win-win situation for everyone.

The policyholders are extremely happy that they have been given a perfect health care system to enjoy the benefits of. They have been able to keep low monthly premium and enjoy bigger benefits. The business schools can learn a lot from the case-study of Medicare and its different branches.

rd/544/70/04302012