Medicare Supplement Health Plans

Medigap plans, a common synonym that is used for Medicare Supplemental Plans that are drafted by the insurance sectors to fill the coverage gaps that are left open by the Medicare Original policies. These gaps consist of the extra cost of co-insurances, co-pays and the deductibles that the beneficiary needs to pay before the insurance coverage starts, depending on the plan handpicked.

An example can be stated of Humana Medicare supplement health plans, which aid in covering the cost gaps and in predicting the future expenses. One of the benefits of having Medicare Supplement Health plans is that one can have same doctors, same hospitals along with same rights of Traditional Medicare Plan

Most of the people mistake Medicare supplement health plans with managed care, but one should keep in mind that they both are different things. Some of these health plans have an added feature of getting treatment abroad if any emergency rises making the plans more portable for the enrollees. Most of the companies keep on adding benefits to attract more enrollees.

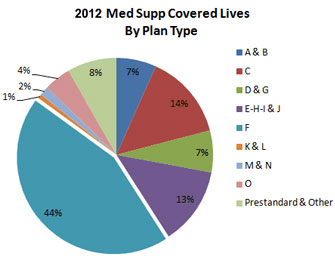

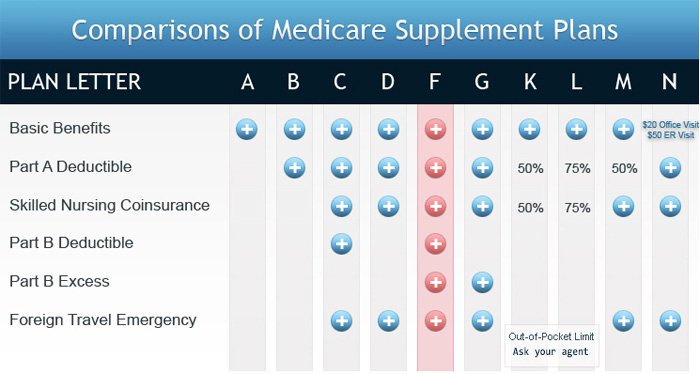

There are ten plans available in the market. All these plans have been named on the alphabets, with each carrying some or the other distinctive features regardless of the location of the plan bought from. The only that varies in these plans is the cost of premiums to be paid depending on the geographical location, making the comparison of the Medicare quotes an important action to execute.

Medicare Supplemental Health Plans from Plan A buttoned up to Plan G are known to offer better number of benefits and low out of pocket expenses with slightly higher price tag and Plan K to Plan N are known as cost sharing programs that offer the same benefits but at a lower cost of premium and higher out of pocket expenses.

- Plan F is considered to be a full on package for those who are stinking rich and have no issues in shedding extra dollars for a complete insurance coverage. These plans come along with a fixed amount of $2,070 as the deductible amount or bit higher amount before actually they start providing with an insurance coverage.

The high on deductible Plan F offers same benefits as the any other Medicare plan after the deductible limit has been met. - Taking Plan K or Plan L, both the plans would pay for any Medicare co-insurance, co-pay or deductibles amount once they have reached the annual brink of the out of pocket expenses for the rest of year. These costs do not include any excess charges.

- Medicare Plans A and Plan B are considered to be basic health plans that are being offered in the market. Plan A offers insurance protection for hospice charges, doctors services and medical expenses, while Plan B offers coverage for Part A deductibles amount and basic medical costs.

- Plan M makes the beneficiary pay half of the Medicare Part A deductible and the entire Part B costs defined for each calendar year. Plan N makes the enrollee pay full amount for Part A and Part B deductibles with a cost of $20 as the co-pay for doctor’s appointment and $50 for trips to emergency rooms.

- If in a situation a doctor refuses to accept the amount fixed for his services, excess charges can be incurred and one would need to pay from owns pocket. If one wishes to avoid these charges they should be opting for Medicare Health Plan F or Plan G.

- Medicare Supplement Health Plans K and Plan L are counted as the plans that have low premium tags encasing the hospital expenses and doctors services. They do cap some percenta

All these Medicare Supplement plans offer insurance coverage to individuals only. If your spouse needs coverage, they would need to apply on an individual basis.

The best time considered while enrolling for Medicare Supplemental Health plans is the six month time period, which consist the three months prior to the birthday month, the month of birthday and the three months post the birthday month. This time period is referred to Open Enrollment Period.

The reason that this period is considered to be the best one is that one would be enrolled irrespective of their health conditions and no insurer can deny them or make them wait for insurance coverage. One can switch to another plan easily. If the open enrollment period expires then insurance company can easily turn down the application for a Medicare plan, but some of the insurers do offer additional enrollment period under certain restricted situations.

One thing that an individual can assured of is that if they lose on their health insurance coverage they would be entitled for Medicare Supplement plans, even if their enrollment period is expired.

If one needs to be a smart shopper and save on extra dollars, they should have an extensive study of Pro’s and Con’s of all plans and compare them with their own requirements for getting best deal.

Mv/930/150/04112012